Based on the webinar on Retirement Planning for Small Businesses and Entrepreneurs

Retirement planning is a crucial aspect of ensuring a comfortable and fulfilling post-work life. In our recent webinar, we covered important topics such as what retirement is, the challenges that come with it, and how to budget and plan for it.

Retirement Challenges

One of the main challenges of retirement is the rising cost of healthcare and long-term care. Inflation, low pensions, volatility, and longevity are also key challenges that must be considered when planning for retirement. To budget for these challenges, it’s essential to factor in housing costs, healthcare costs, day-to-day living expenses, entertainment, travel, and big-ticket items.

How much is enough?

Experts recommend aiming for 70-80% of pre-retirement income as a target for retirement savings. This can vary globally, and some may require a fraction of their current expenses or income. A 100% replacement of income in retirement is also recommended.

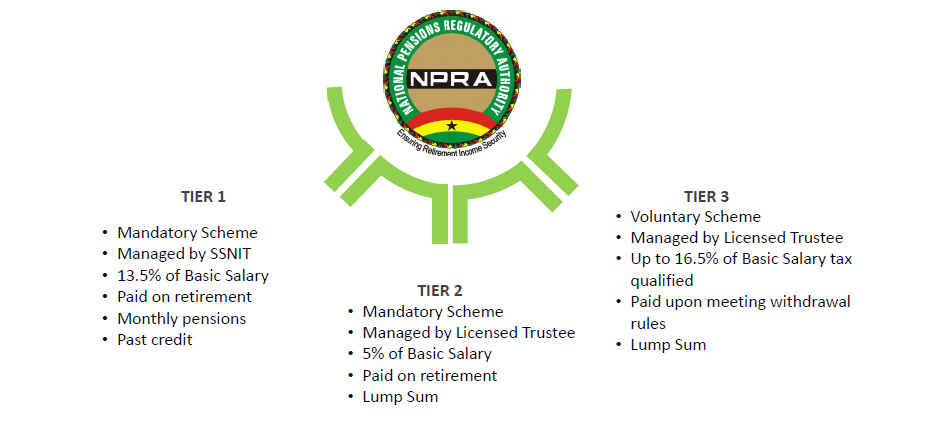

Structure of Pension Funds in Ghana

Other sources of retirement income

Other sources of retirement income include children/family, investments, business, and rental income.

Retirement Planning Advice

Other sources of retirement income include children/family, investments, business, and rental income. To plan for retirement, it’s important to max out retirement tax savings opportunities, save at least 10% of your income towards retirement, have an emergency fund, plan for capital expenses, consider inflation, healthcare costs, and longevity, increase contributions as income increases, avoid withdrawing retirement savings, monitor pensions, and start saving towards retirement as early as possible.

In addition to financial considerations, retirement planning should also include taking care of one’s health, building strong relationships, finding suitable accommodation, and having an occupation or hobby to keep busy.

Key things to remember

Key notes to remember include how long you save, how much you save, how much return you achieve, when you retire, how much income you seek, how long you live, inflation, and healthcare cost.

In summary, retirement planning is crucial to ensure a comfortable and fulfilling post-work life. By considering the financial and non-financial aspects of retirement, one can ensure they have the resources and support they need to live a happy and fulfilled life.

For those who missed the webinar, the recording is available on YouTube

The article was written by the Pocketi team based on a presentation by Mimi Anane-Appiah (Finance Advisor – Axis Pension Trust)

Learn about Pocketi App for small businesses

About Pocketi

Pocketi app is a comprehensive payment and invoicing platform designed for small businesses in Ghana. It allows businesses to easily create and send invoices to customers via SMS, receive payments electronically, and even track orders and sales through an online portal. With no subscription, hidden, or monthly fees, our platform is a cost-effective way to streamline business operations and improve cash flow.

To learn more about Pocketi, download it for free, or contact our team, visit our website. Pocketi app is available for download on the App Store and Google Play. With our intuitive and user-friendly platform, small businesses in Ghana can take control of their financial future and achieve greater success.